Report: NH leaves up to $1.2B on table with corporate tax cuts

—

| Published: 04-07-2025 9:01 AM |

Cuts in corporate tax rates since 2015 have led to up to $1.2 billion in forgone state revenue, according to a report a nonpartisan research group released Tuesday as lawmakers considered millions of dollars in spending reductions.

The N.H. Fiscal Policy Institute’s report shows the state left $795 million to $1.17 billion on the table over the past decade by reducing the business profits and the business enterprise taxes.

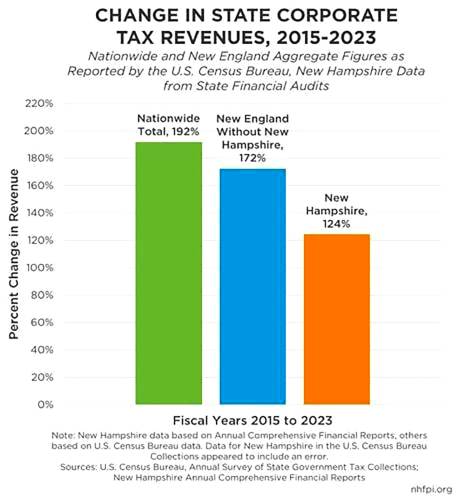

New Hampshire’s corporate tax revenues grew 124 percent during this period, compared to 167 percent growth in Maine and 166 percent in Vermont, two states that didn’t reduce their top corporate tax rates. Nationally, state corporate tax revenues grew 192 percent over the past decade.

Republican leaders often say tax cuts stimulate the economy and boost state revenue.

Democratic lawmakers counter that such reductions slash tax dollars needed to pay for such things as public education, health care and law enforcement. They contend this also has the effect of increasing local property taxes.

N.H. Rep. Rosemarie Rung, D-Merrimack, railed against business tax cuts in a subcommittee meeting last week as she sought to preserve funding for the state library and for arts programs.

“I think it’s absolutely abhorrent that we’re discussing zeroing out, firing people at the state level in these departments that are focused on the state library and arts,” she said. “This is a self-inflicted situation by the continual decrease in state revenues over the years.”

Rung also lamented Republican-led cuts in the state’s interest and dividends tax, a levy on wealth that annually brought in about $150 million before it was eliminated this year. She said lawmakers who favored revenue cuts in recent years should have considered spending cuts at the same time.

Article continues after...

Yesterday's Most Read Articles

Federal judge temporarily reinstates legal status for Dartmouth graduate student

Federal judge temporarily reinstates legal status for Dartmouth graduate student

West Lebanon bridge reopens to vehicles

West Lebanon bridge reopens to vehicles

Former Dartmouth ski team member dies in accident in California

Former Dartmouth ski team member dies in accident in California

Upper Valley Tesla owners among those rethinking their purchases

Upper Valley Tesla owners among those rethinking their purchases

Prosecutors seek prison term of at least 30 years for man convicted at Dartmouth rape trial

Prosecutors seek prison term of at least 30 years for man convicted at Dartmouth rape trial

Upper Valley donut maven Muriel Maville dies at 87

Upper Valley donut maven Muriel Maville dies at 87

“So, I’m just really upset,” she said. “I think it’s really going to be a wake-up call to Granite Staters when they are living in a state where their representatives aren’t even supporting these types of programs, a library and arts.”

Rep. Joe Sweeney, R-Salem, defended corporate tax cuts at the March 24 hearing, making an argument that ran counter to what the Fiscal Policy Institute ultimately found in the study it released Tuesday. (The House Finance Committee ended up recommending cutting funding for the arts, but preserving the state library.)

“Over time, since 2015, reducing the business profits tax and the business enterprise tax has led to more economic growth and more tax collections from those taxes than would have if we kept the rates the same and didn’t make any reductions,” he said.

Sweeney also said elimination of the interest and dividends tax, much of which is paid by the wealthy, will help senior citizens living on fixed incomes, who then would be free to use their savings and donate to local arts programs.

“The myth that cutting business taxes has cost us revenues is inaccurate,” he said. “Cutting business taxes has allowed our economy to grow and we’re collecting more today in business tax revenues than we were when the rates were higher, even when you can scale it out due to inflation.”

The Fiscal Policy Institute analysis, however, provides evidence that reduced tax rates have led to lower tax revenue.

In addition to citing the experience in Vermont and Maine, the study found that, among other things:

Business enterprise tax revenue declined, relative to the tax base, after each rate reduction.

There was no significant statistical relationship between business profit tax rates and job growth.

National corporate profits have surged, and high-profit companies pay most of the business profits tax.

The N.H. Legislature is working on submitting a budget to Gov. Kelly Ayotte covering the 2026 and 2027 fiscal years. That budget will start on July 1, and the current two-year budget will end June 30.

She has submitted a budget of about $16 billion, but fiscal analysts in the N.H. House found that her revenue estimates were overly optimistic. They are looking to make about $500 million in spending cuts to balance expenditures and expected revenues in the new budget.

These articles are being shared by partners in the Granite State News Collaborative. For more information, visit collaborativenh.org.

Upper Valley businesses feel the sting of rising cocoa prices

Upper Valley businesses feel the sting of rising cocoa prices New Hampshire House passes slimmed-down budget, as Ayotte vows to restore some cuts

New Hampshire House passes slimmed-down budget, as Ayotte vows to restore some cuts Board schedules revote on bond for Bethel and Royalton schools

Board schedules revote on bond for Bethel and Royalton schools